betterment tax loss harvesting white paper

This white paper summarizes the motivation design and historical results of Wealthfronts Tax-Loss Harvesting service. Our actual results demonstrate that Tax-Loss.

Wealthfront Vs Betterment Which Robo Advisor Is Best One Shot Finance

The Goals and Benefits of Betterment Tax Loss Harvesting.

. A combination of tax-coordinated portfolios. What is tax-loss harvesting. Updated October 11 2022.

Some tax loss harvesting methods switch back to the primary ETF after the 30-day wash period has passed. Betterment does all of this automatically via its low-cost index fund ETF portfolio. As your money grows and your priorities change we evolve with ongoing advice and updates to help you stay on track.

Neither Betterment LLC nor Betterment Financial LLC nor any of their affiliates is a bank. Tax Loss Harvesting - Betterment Item Preview. Our technology manages your money and helps you earn more.

Delay reinvesting the proceeds of a harvest for 30 days thereby ensuring that the repurchase will not trigger a wash sale. You should carefully read this disclosure and consider your personal circumstances before deciding whether to utilize Betterments Tax Loss. Not FDIC Insured No Bank Guarantee May Lose Value.

Betterment increases after-tax returns by a combination of tax-advantaged strategies. Tax-loss harvesting has been shown to boost after-tax returns by as much as 077 annually while tax-smart asset allocation can increase returns by as much as 15 over a 30 year period. Step 3 Our technology gets to work.

Investing in securities involves risks and there is always the potential of losing money when you invest in securities. Betterment is one of the few robo-advisors that dont require a minimum balance to provide clients with automatic tax-loss harvesting. We strive to optimize every dollar you spend save and invest with us.

In highlighting the betterment. Tax Loss harvesting is the practice of selling a security that has experienced a loss. This can create short-term capital gains tax that may dramatically reduce the.

In simplest terms tax-loss harvesting is a process of selling investment assets that have lost value in the year to claim those losses against gains for tax. The higher your tax bracket the more youll benefit from tax. Recently many personal finance and investment websites have made the general public aware of a concept known as tax-loss harvesting.

Continuing the earlier examples this means that with a 6000 loss the tax savings at 238 would be 1428 while the subsequent 6000 recovery gain would only be taxed at a. In a nutshell when one of your underlying investment funds. Betterment wrote a white paper on TLH.

Betterment Taxes Summary. In its white paper on the Betterment tax loss harvesting program Betterment goes into detail about many issues surrounding ETF. By realizing or harvesting a loss investors are able to offset taxes on both gains and.

Betterment Tax Loss Harvesting White Paper. But there is another way to get even more out of your portfoliousing investment losses to improve your. While its the easiest method to.

In its white paper on the betterment tax loss harvesting program betterment goes into detail about many issues surrounding etf investments and how its program works better.

The Definitive Guide To Tax Loss Harvesting And Avoiding Wash Minafi

Betterment Review Portfolio Rebalancing In Its Finest

Should I Invest My Money With Betterment In 2021

Wash Sale Rule What To Avoid When Selling Your Investments For A Tax Loss Bankrate

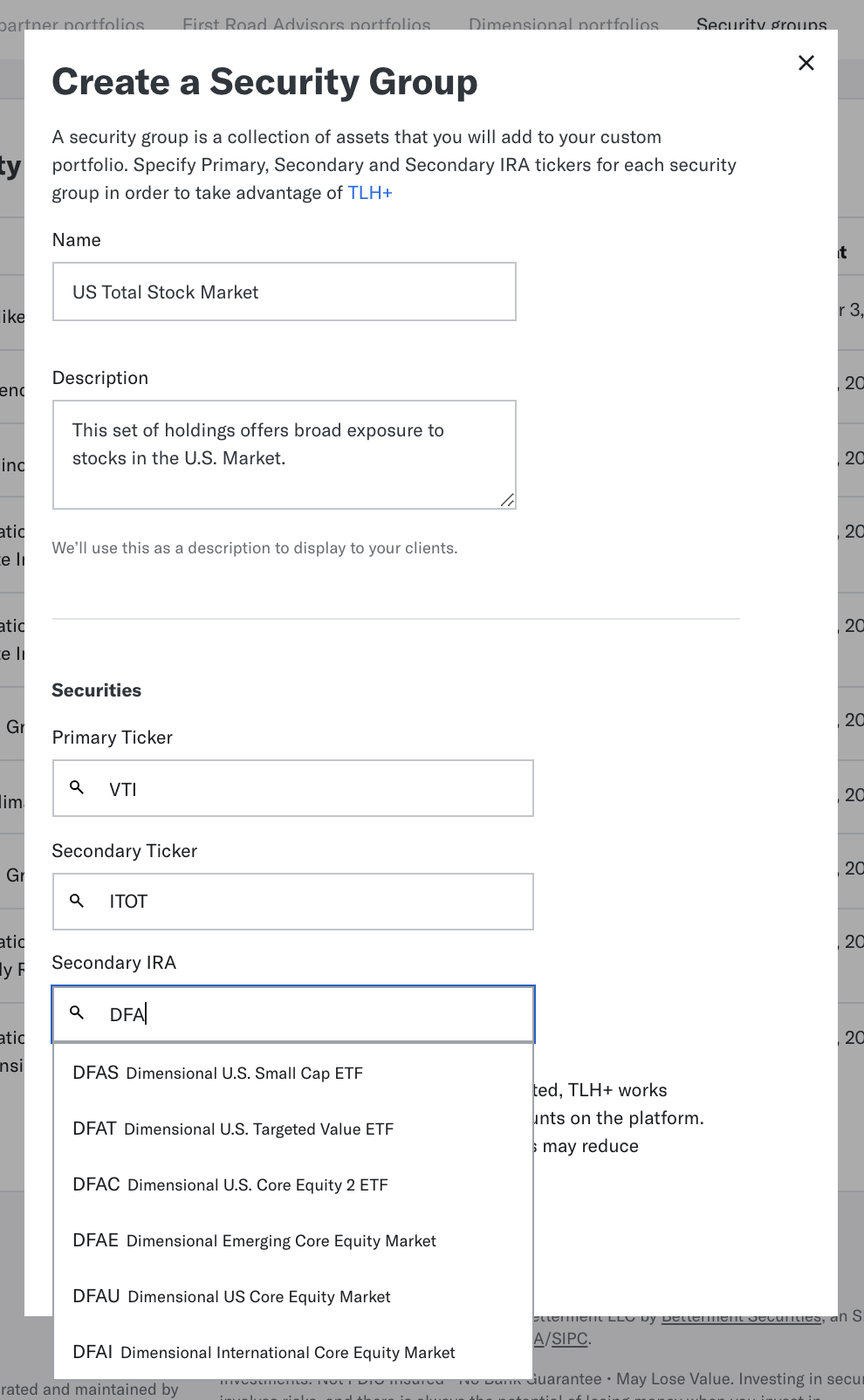

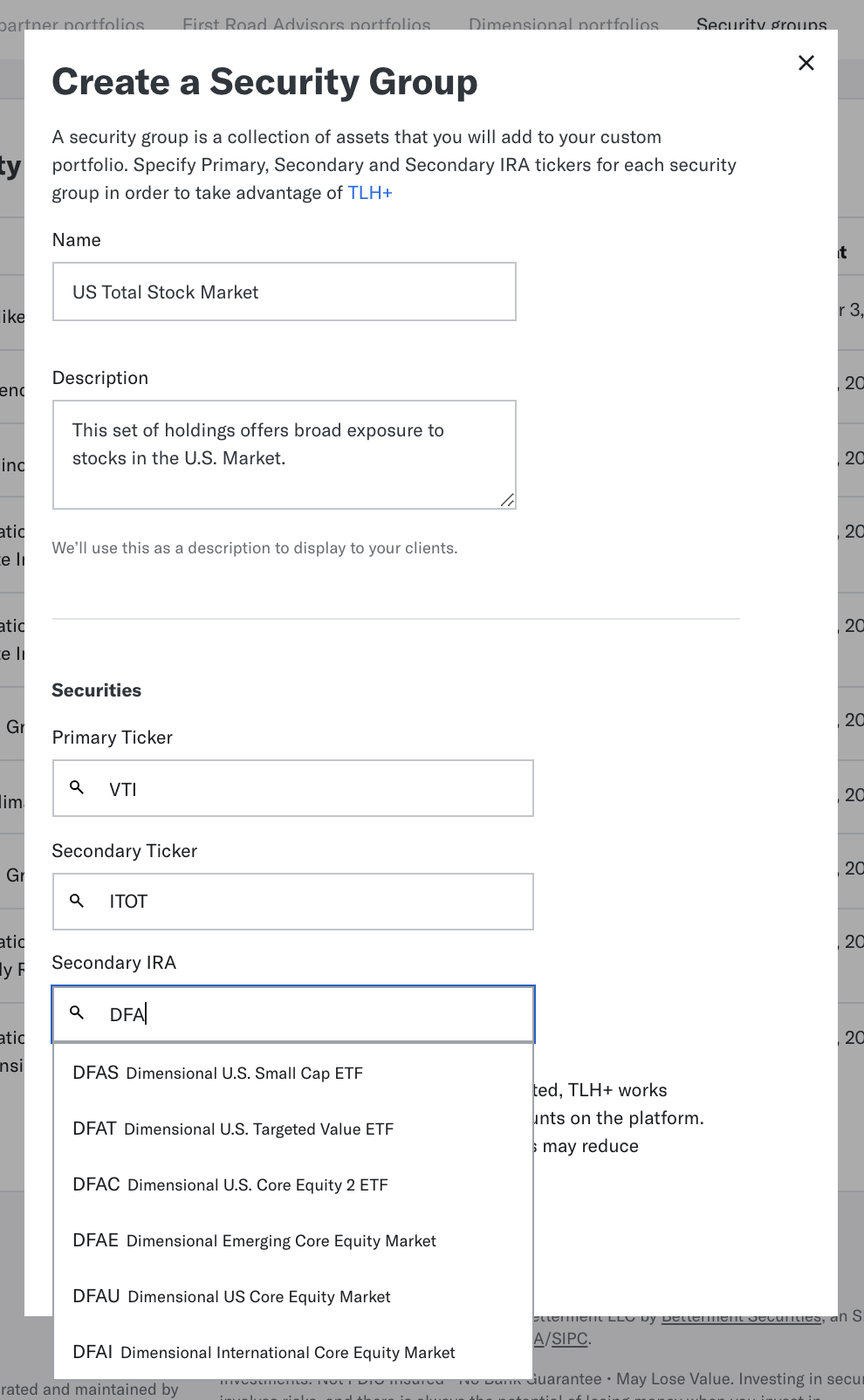

Betterment Revamps Custom Portfolios Hints At Direct Indexing Wealth Management

A Detailed Review Of Betterment Returns Features And How It Works

Betterment Tax Loss Harvesting Review What You Should Know About The Betterment Tax Program Advisoryhq

Should I Invest My Money With Betterment In 2021

Betterment Review 2022 What You Need To Know About This Robo Advisor

Wealthsimple Vs Betterment Vs Vanguard Which Is A Better Fit For You

Top 5 Tax Loss Harvesting Tips Physician On Fire

Betterment Vs Wealthfront Vs Acorns Which Robo Advisor Wins In 2022

Tax Loss Harvesting With Vanguard A Step By Step Guide Physician On Fire

How To Deduct Stock Losses From Your Taxes Bankrate

Top 5 Tax Loss Harvesting Tips Physician On Fire

![]()

Tax Loss Harvesting Methodology

Why I Put My Last 100 000 Into Betterment Mr Money Mustache